A Point in Time

Investing in the stock market can give you a nasty case of emotional whiplash if you’re not careful. One minute, you’re languishing in a nearly 2-year-old bear🐻market set against a backdrop of geopolitical tensions, rising interest rates and slow economic growth. The next, the S&P 500 breaks 4800 for the first time and the world celebrates a new market all-time high (ATH). In fact – the S&P 500 may have waited 511 days in between ATHs but it decided to make up for lost time by subsequently delivering 5️⃣ new ATHs in a row💪🏼💥! Pop the champagne, baby🍾!

Seriously, though. Being an investor can be exhausting😩. And since the financial media is not in the business of offering sound investment advice, we are going to Sanctuary ‘sPLAIN the significance of ATHs and what they mean for you as an investor.

The big question many are asking these days is: since the market is at an ATH – is now a good time to invest?

Let’s consider three things.

First – let’s look at how the market has historically performed after a new ATH:

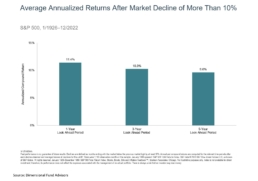

Second – let’s look at how the market has historically performed after a decline of more than 10%:

Hmmm🤔. There’s not a significant difference between the two. Whether the market is charting new highs or retreating from its highs, long-term performance seems to be…consistent. The fact that the market is at an ATH is nothing more than a point in time. That is all.

Which brings us to point number three and that is: has anything changed with you and your goals? Because frankly, that is what we’re most interested in. The decision to invest should not be based on headlines or ATHs or politics or who wins the Super Bowl. The decision to invest should be based on you and the things you want to accomplish with the resources you have. It is why we encourage all clients to draft a Statement of Financial Purpose. So, you know your WHY and you can let that guide you regardless of what the market is doing.

ATHs might be a catalyst for positive and uplifting headlines, but they aren’t a catalyst for changing investing strategies. Nor are they uncommon. From 1929 through January 26th, 2024, the S&P 500 has set a new ATH 1,310 times. Which means if anything, ATHs serve as a reminder that innovation and human ingenuity drive long-term growth over time.

Please reach out to sarah@sanctuaryfp.com or jim@sanctuaryfp.com with your questions.