Investments

Smart investing starts with a clear, evidence-based strategy— not forecasts or fads. It’s built for the long term and designed to keep you confident through the ups and downs.

Your investments should support your life — not complicate it.

Whether you want to stay hands-on or delegate entirely, we offer flexible options designed to match your style, your comfort level, and your financial strategy.

How it works

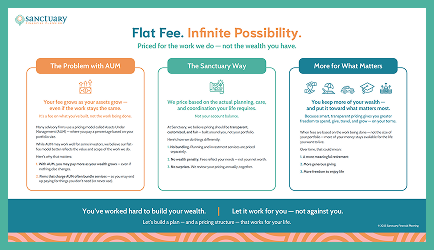

Because what you pay your advisor matters.

Most advisors charge based on the value of the assets they are managing for you. This means that as your assets grow, your fees grow. But at Sanctuary, we charge flat fees based on the work we do — not the size of your portfolio — so the only person who makes more money when your assets grow is YOU!

More clarity, less conflict

Because our fees aren’t tied to your portfolio size, you can trust that our advice is focused on your goals — not our compensation.

You keep more of what you’ve built.

With flat-fee pricing, you’re not penalized for growing your wealth. That means more money for the things that matter most to you.

Pay only for what you need

Whether you want one-time guidance or ongoing reviews, you’ll only pay for the level of investment help that fits your life right now.

Investments

How it works

Choose your level of involvement

Prefer to delegate? We’ll manage your portfolio, align it with your plan, and keep it on track.

Want to stay in control? We’ll offer strategy, reviews, and guidance without taking over.

Priced for the value we deliver, not the size of your account.

You won’t pay more just because your portfolio grows.

Our flat fees are based on the complexity of your needs — not your net worth — which keeps advice objective and conflicts of interest low.

Stay supported as life and markets evolve

After your initial investment review, you can opt into ongoing guidance as needed.

We’ll be here when you want a check-in, perspective shift, or strategy refresh.

Investment Management

Ideal for clients who want their portfolio fully managed — with strategy, execution, and monitoring handled for them.

- We manage your portfolio — aligning it with your plan, rebalancing for risk and taxes, and coordinating implementation.

- We take care of the strategy and day-to-day management, so your investments stay on track — and you can stay focused on your life.

Fee:

Starting at $5,000/year

Investment management fees are based on the scope and complexity of your portfolio — including factors like number of accounts, tax considerations, money movement and coordination needs. Just like your planning fee, we revisit this together each year to ensure it’s aligned with the level of support you need.

Investment Guidance & Oversight

Designed for clients who want to stay in control — with expert strategy in their corner.

- We begin with a one-time analysis of your portfolio

- You manage your investments, but we review your holdings, analyze your allocations, and offer tailored recommendations that align with your financial plan.

- This includes allocation guidance, implementation tips, and recommendations on how to consolidate or streamline where appropriate.

Fees:

$500 meeting fee

$350 per portfolio/account analyzed

Optional Ongoing Investment Oversight

Ideal for clients who want to stay hands-on but value structured accountability and strategic updates.

- Ongoing strategy sessions to provide reassurance, updated recommendations, and support as your life — or the markets — evolve.

- We assume you’ve implemented our guidance, but we’re here to help refine the strategy over time and offer perspective when you need it most.

Fee:

$1,000 per meeting (recommended 1–2x/year)

Investments

What guides us

Patience Pays

Markets reward those who stay the course. Daily swings stir emotions, but long-term discipline and compounding drive real results.

Facts Over Fortune-Telling

Hot stock tips sound exciting, but they rarely work. We follow decades of research to guide every decision.

Spread the Risk

We diversify broadly to reduce risk — so you don’t have to rely on picking winners to succeed.

Keep It Simple

Smart investing doesn’t need to be complicated. Low-cost, globally diversified funds keep costs down and your strategy focused.

Fees Matter

Every dollar counts. We build low-cost, tax-aware portfolios so you keep more of what you earn.

Invest with Purpose

Money isn’t the goal — it’s a tool to help you uncover the why behind your plan. Because wealth without purpose misses the point.

Investment FAQs

Do I need to have a Foundation Plan in place to use your investment services?

Generally, yes. We believe investment management is most effective when it’s fully integrated with your financial plan. However, in select cases, we may offer it as a standalone service. Reach out to learn more.

Do you offer investment guidance if I don’t want full management?

Yes. If you’d rather manage your own accounts — or keep them at another custodian — we can still provide strategy, advice, and oversight through your financial plan. You get professional guidance without giving up control.

Can you help me manage old 401(k)s or employer plans?

Yes. As part of our investment guidance, we can recommend allocations and strategies for your old 401(k)s or other employer accounts — even if they stay where they are.

Can I keep my current holdings or advisor?

We’ll review your current holdings and, where it makes sense, incorporate them into your strategy. If you’re working with another advisor on certain accounts, we can coordinate to keep your overall plan aligned.

What is your investment philosophy?

At Sanctuary we believe that markets are efficient, and that clients are well served by a globally diversified portfolio comprised of low-cost ETFs and mutual funds. We use financial science and academics to guide our decisions, and we don’t believe in market timing or individual security selection.

As Nobel-prize winning economist Paul Samuelson said: “Investing should be dull. It shouldn’t be exciting. Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

Download our Core Investing Beliefs to learn more.

Do you offer socially responsible or ESG investing options?

We’re happy to explore ESG options when it aligns with your values and goals.

Where are my investments held?

We use Charles Schwab as our primary custodian. Your accounts are held securely in your name at Schwab, and we manage them directly from there. Schwab is one of the largest and most trusted custodians in the country, providing you with account protection, security, and peace of mind.

Who makes decisions about my portfolio?

We do — with your goals as our guide. We provide discretionary management, so we can make smart, timely decisions on your behalf, always within the strategy we’ve built together.

How often will we review my portfolio?

We monitor your portfolio year-round, but formal reviews happen as part of your annual planning meeting. If you’d like additional portfolio meetings throughout the year, we’re happy to schedule them for an additional fee.

What is your minimum fee for investment management?

Our minimum fee is $5,000 per year. We review and set your fee annually to reflect your needs — no surprises.

Can I choose how I pay the fee?

Yes. You can pay directly via ACH or credit card, or you can choose to have fees deducted from your investment accounts. We give you full control over how you’re billed.

Will my fee change over time?

Potentially — and if it does, you’ll always know why. Like our planning services, investment management is a one-year engagement. We reassess annually to ensure your fee reflects the complexity of your portfolio and your needs for the year ahead.

What factors might increase my fee?

Our $5,000 minimum sets a reasonable starting point, but fees may increase based on the complexity of your needs. We’ll always discuss this with you upfront. Factors may include:

- Advanced tax strategies like Roth conversions or tax-loss harvesting

- Non-standard investments like legacy holdings or alternative assets

- Frequent money movements or real estate transactions

- Managing more than five accounts or complex account structures

Are there any services you don’t offer?

Yes — and that’s by design. We avoid strategies that add unnecessary complexity or lack clear, evidence-based value. That means no individual stock picking, no bond ladders, and no speculative or illiquid investments like crypto, hedge funds, or private equity. We stick with low-cost, diversified portfolios built to support your long-term goals — no noise, no gimmicks.

What happens if my needs change mid-year?

We’re here to help. If your situation becomes more complex, we’ll work with you to adjust your engagement accordingly — or, if needed, handle additional work at our standard hourly rate.

What if I want to stop investment management?

No problem. Investment management is a one-year engagement, just like our planning services. If you decide not to renew, you can continue with planning only, or pause entirely — no pressure, no hassle.

Helpful Takeaways

Investing with Purpose

Our philosophy is built on principles that stand the test of time.

Are you ready to take control of your financial life?

Schedule your free Inquiry Call to get started toward finding your financial sanctuary.

- Learn how we can help

- Ask all of your questions

- Decide if we're a good fit