A revolutionary approach to wealth, purpose, and What’s Next.

A revolutionary approach to wealth, purpose, and What’s Next.

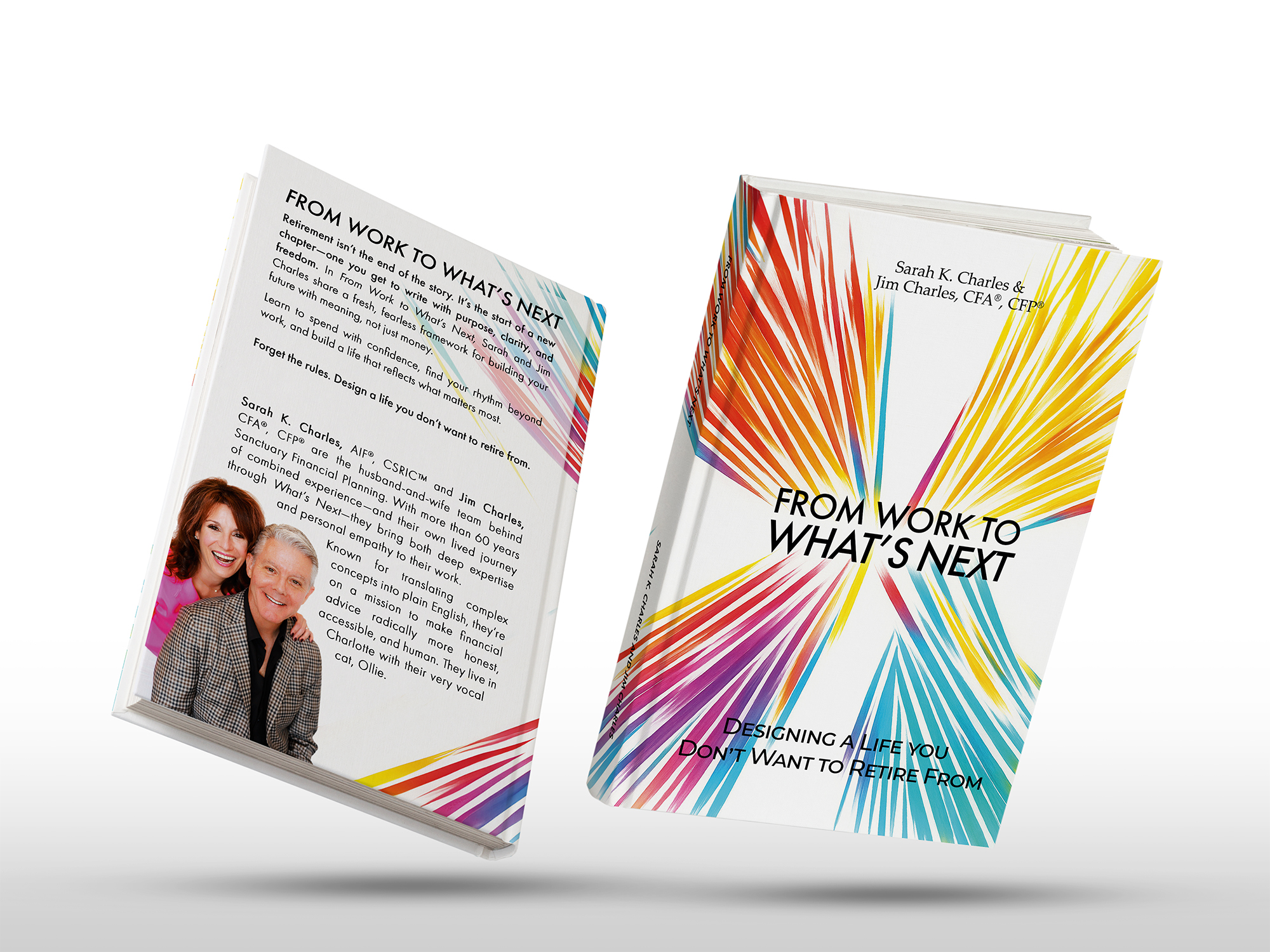

Drawing on decades of financial expertise and their own lived experience, Sarah and Jim Charles guide you through one of life’s biggest transitions with honesty, humor, and heart.

This isn’t about waiting for your “golden years” to start living. It’s a conversation—about meaning, money, and what it takes to design a life you don’t want to retire from—at any stage.

Whether you’re building wealth, navigating career transitions, or reimagining what’s next, this book will help you move with clarity, courage, and confidence into a future that’s deeply, unmistakably yours.

Sarah and Jim Charles didn’t set out to revolutionize financial advice—they just got tired of watching an industry that puts portfolios before people.

After living through Jim’s own “failed retirement” (his words) and watching too many clients struggle with cookie-cutter plans that ignored their actual lives, they founded Sanctuary Financial Planning to do things differently. No asset minimums. No percentage-based fees. No reducing human beings to balance sheet numbers.

Sarah brings two decades of experience making complex financial concepts feel approachable and actionable. A breast cancer survivor and passionate advocate for women’s financial empowerment, she believes money is a tool for living meaningfully—not just accumulating wealth. When she’s not translating tax code into plain English, you’ll find her tending to her garden or being “Bella” to twin granddaughters.

Jim’s 30-year career in financial planning includes leadership at one of the world’s largest investment firms—experience that taught him what works and, more importantly, what doesn’t. A jazz enthusiast, CFP® certificant, and CFA charterholder who learned the hard way that traditional retirement advice often falls short in real life, Jim brings both institutional expertise and personal insight to the challenge of navigating life transitions.

Together, they wrote From Work to What’s Next because they believe everyone deserves advice that’s built around their life story, not just their net worth. Their mission: helping people create futures so fulfilling, they’ll never want to retire from them.

Most financial advisors still charge using the “assets under management” (AUM) model—and it’s quietly rigging the game against you.

On the surface, it looks simple: pay about one percent of your portfolio each year for ongoing advice. It was designed as an improvement over the old commission-heavy sales culture.

But here’s what they don’t tell you: the AUM model wasn’t built to help you live well. It was built to help advisors profit—whether you thrive or not.

As financial journalist Bob Veres put it: “AUM is commission in sheep’s clothing.”

Download our free guide to see exactly how this system works—and how it’s costing you more than money.

Most financial advice treats everyone the same – save X%, retire at 65, follow the formula. But your life isn’t a formula.

At Sanctuary, we believe in stage-based planning, not age-based rules. Whether you’re building wealth, navigating complexity, testing transitions, living your plan, or refining your legacy – we meet you where you are and help you design what comes next.

Explore the stage that resonates most with you. Each playbook includes relatable case studies, specific guidance, and a clear picture of how we’d work together to support your goals.

Download the playbook that speaks to your current situation,

or explore several to see how our approach evolves with you.

Maya and Peter are financially stable, but growing wealth brings complex choices around housing, college savings, estate planning, and investments.

Chris and Monica are doing well and saving steadily, but with kids in school and college, they’re now weighing tuition, retirement moves, and long-term flexibility.

Mark and Jenna are eyeing major life changes, including career shifts, travel, and honoring a philanthropic pledge—all while considering a drop in income.

Noah and Avery are excited to retire but overwhelmed by pension choices, rollovers, Social Security, Medicare, and replacing their paychecks.

Eleanor is financially secure but seeking simplicity through downsizing, giving during her lifetime, and ensuring her plans reflect her values and are clear to her family.

This planning experience might be the right fit if you’ve ever found yourself thinking…

If any of these sound like you, you’re not alone — and you’re in the right place.

And if you’re unsure, that’s okay — many of our clients started with questions, not answers. Let’s figure it out together.

Your future deserves more than a generic plan. Let’s set aside 30 minutes to talk about where you are, where you want to go, and how Sanctuary can help you build a life you don’t want to retire from.