The Foundation Plan

What if financial planning wasn’t just about numbers — but about the freedom to live life on your own terms?

It all starts with a strong foundation

Financial planning isn’t just for the ultra-wealthy or those nearing retirement.

Whether you’re building wealth, navigating change, or designing your next chapter — having a plan gives you a framework for intentional decisions, not reactive ones.

The Foundation Plan

Financial planning for every stage

Starting Out

You’re making good money. Are you using it wisely?

You’re earning, saving, and investing, but unsure if you’re on track. We’ll create a clear plan so you know your money is working effectively.

In the Thick of it

You’ve got a lot in motion. How do you keep it all aligned?

Between careers, kids, aging parents, and competing goals, life feels full. We help you tie it all together with one cohesive strategy.

Gaining momentum

Are you missing opportunities without even realizing it?

It’s easy to overlook financial blind spots when things seem to be going fine. We help you spot potential gaps and plan ahead with confidence.

Planning the next chapter

You’re thinking about what’s next. Where do you start?

You’re not retiring yet, but you’re ready to explore the possibilities. We’ll help you map out what’s ahead without rushing the decision.

Ready to enjoy life

You’ve saved for the future. How do you turn it into a life?

The money is there, but the next chapter feels uncertain. We’ll show you how to turn savings into a sustainable, purpose-driven plan.

Riding the ups and downs

How do you plan ahead when life is so uncertain?

Life doesn’t always follow a straight line. We help you build a flexible strategy that can adapt as your goals, family, or career evolve.

The Foundation Plan

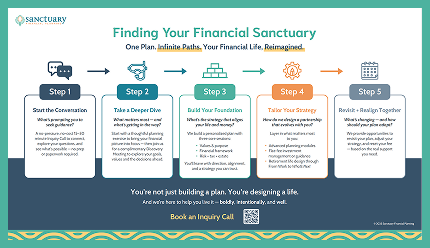

Finding Your Financial Sanctuary

What to expect

Before the Numbers

Real planning starts with real life. This first conversation helps you reflect on where you’ve been, what matters now, and how you want to move forward.

We’ll explore:

- Your Money Story (past): What shaped your mindset and behaviors?

- Your Statement of Financial Purpose (present): What role does money play in your life?

- Your Values & Energy Map (future): Where do you want your time, energy, and money to flow?

You’ll walk away with:

- A personalized Statement of Financial Purpose

- A Wheel of Life visual to assess balance and fulfillment

- 1–2 intentional steps you can take immediately to align your life and your finances

The Financial Framework

With clarity around your values, we begin turning insight into action. This is where your financial picture comes into focus — and the strategy starts to take shape.

We’ll explore:

- Cash flow & savings strategy: Are you using your income intentionally?

- Investment alignment: Are your assets working toward your goals?

- Tax awareness: Are you avoiding missed opportunities?

- Scenario modeling: What if you retire early? Take a sabbatical? Buy a second home?

You’ll walk away with:

- A clear, client-friendly Strategic Planning Summary

- One or more customized scenarios reflecting what matters most to you — right now

- A plan that helps you stop guessing — and start making confident decisions

Risk, Protection, and Preparation

Now we zoom out to make sure your plan is built to last. It’s not about predicting the future, but preparing for what you can’t control.

We’ll explore:

- Insurance landscape: What risks should you be prepared for, and how do you protect against them?

- Estate essentials: Are your estate documents and decisions aligned with your goals?

- Taxes – the long game: What does your tax picture say, and how can you plan more effectively?

You’ll walk away with:

- High-level guidance and conversation prompts across protection strategies, estate planning, and tax planning

- A customized tax report with key observations and long-term planning insights

- Checklists and visuals to coordinate with your CPA, attorney, or insurance pro

- A clearer sense of where not to worry — and where proactive planning really matters

The Foundation Plan

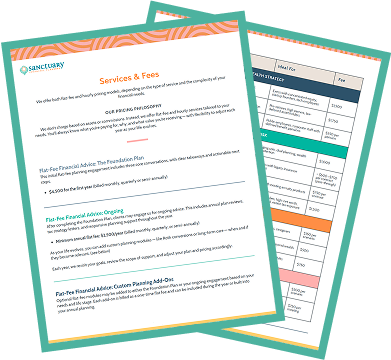

Pricing

Starting at $4,500

The Foundation Plan is a one-year commitment.

We don’t charge based on how many meetings you need or how fast you move

You can choose to pay monthly, quarterly, or semi-annually

At the end of the year, we’ll check in and adjust your plan together as needed, based on your goals

Add-Ons

Beyond the Foundation: Customize Your Planning

We start with a strong foundation, but no two financial lives are the same. That’s why our flat-fee planning is fully customizable. Depending on your goals, we offer additional services to deepen and personalize your plan.

Foundation Plan FAQs

If every client starts with the Foundation Plan, how custom is the process?

Every client starts with the same building blocks — but what we build together is completely customized. The Foundation Plan gives us a flexible structure to uncover what matters most to you, and then shape a strategy that fits your life, your goals, and your values.

What’s included in the Foundation Plan?

Before we talk numbers, we start with the building blocks: your financial framework, goals, and values. Then we layer in core planning areas like cash flow, tax strategy, estate planning, insurance, and more — giving you a strong, well-rounded foundation.

The Foundation Plan is a 1-year commitment. What happens after that?

Near the end of your Foundation Plan, we’ll revisit your priorities and outline what the next year could look like. If you choose to continue, we offer tailored ongoing support through a new annual engagement. Learn more about Ongoing Financial Advice.

How long does the Foundation Plan process take?

Some clients move through the plan quickly, while others take more time — it depends on your goals, schedule, and pace. Most people complete the full experience over 9–12 months.

What if I fall behind or get busy during the year?

It’s okay. The pace is flexible, and we’ll meet you where you are. We’re here to keep you moving forward—even if life throws you a curveball.

The first year starts at $4,500. How much will it cost after the first year?

The annual minimum for Ongoing Financial Advice is $2,500. Fees are set each year based on what you need, and can include planning add-ons or investment support. Learn more about Ongoing Financial Advice.

Is there a commitment beyond the Foundation Plan?

No — there’s no obligation to continue after the first year. But financial planning isn’t a one-and-done event. It’s an ongoing process, and most clients choose to keep going because life keeps changing.

What happens if I need help with something that’s not included in the Foundation Plan?

We offer Planning Add-Ons for more specialized or complex needs that fall outside the core plan.

What if something big changes in my life during the Foundation Plan?

Life happens — and we’re built for that. If priorities shift mid-year, we’ll adapt and re-align as needed.

Are you available to me if I have questions or need help with my plan?

Yes. While the plan is structured around three core meetings, you’re welcome to reach out between meetings with questions or requests — we’re here to help.

Will you help me execute my plan?

Yes. We’ll guide you through your action items and provide support with follow-through, coordination, and decision-making as you implement your plan.

Do I need to have a minimum amount of money to work with you?

No minimums here. We believe everyone deserves a financial plan, regardless of portfolio size or income.

Can I meet you and ask questions before I commit to anything?

Absolutely. Start with a no-cost Inquiry Call to get to know us, and if it feels like a fit, we’ll move to a no-cost Discovery Call to explore the best path forward. Learn more about the process here.

Helpful Takeaways

Services & Fees

A full menu of our services, our prices, and how it all fits together.

Are you ready to take control of your financial life?

Schedule your free Inquiry Call to get started toward finding your financial sanctuary.

- Learn how we can help

- Ask all of your questions

- Decide if we're a good fit