Flat-Fee Financial Planning Packages

No hidden fees. No surprises. You choose the package that best fits your situation.

How do we do it?

Perspective

What is your relationship with money?

What are your values and priorities?

Are you using your money in a way that’s improving your life?

The right foundation matters.

We help you establish and maintain a balanced relationship with money that aligns with your purpose.

Financial Framework

What steps do you need to take to reach your goals?

How are your finances working together?

Do you understand the big picture?

No confusing plans here.

We work with you to provide clear advice to help you navigate all of your financial decision making.

Investments

Are you invested in the right places?

Are you paying too much in investment fees?

Is your investment strategy aligned with your growth goals?

We don’t manage your assets.

But we do make sure they are supporting your financial plan in the best way possible.

Why flat fee?

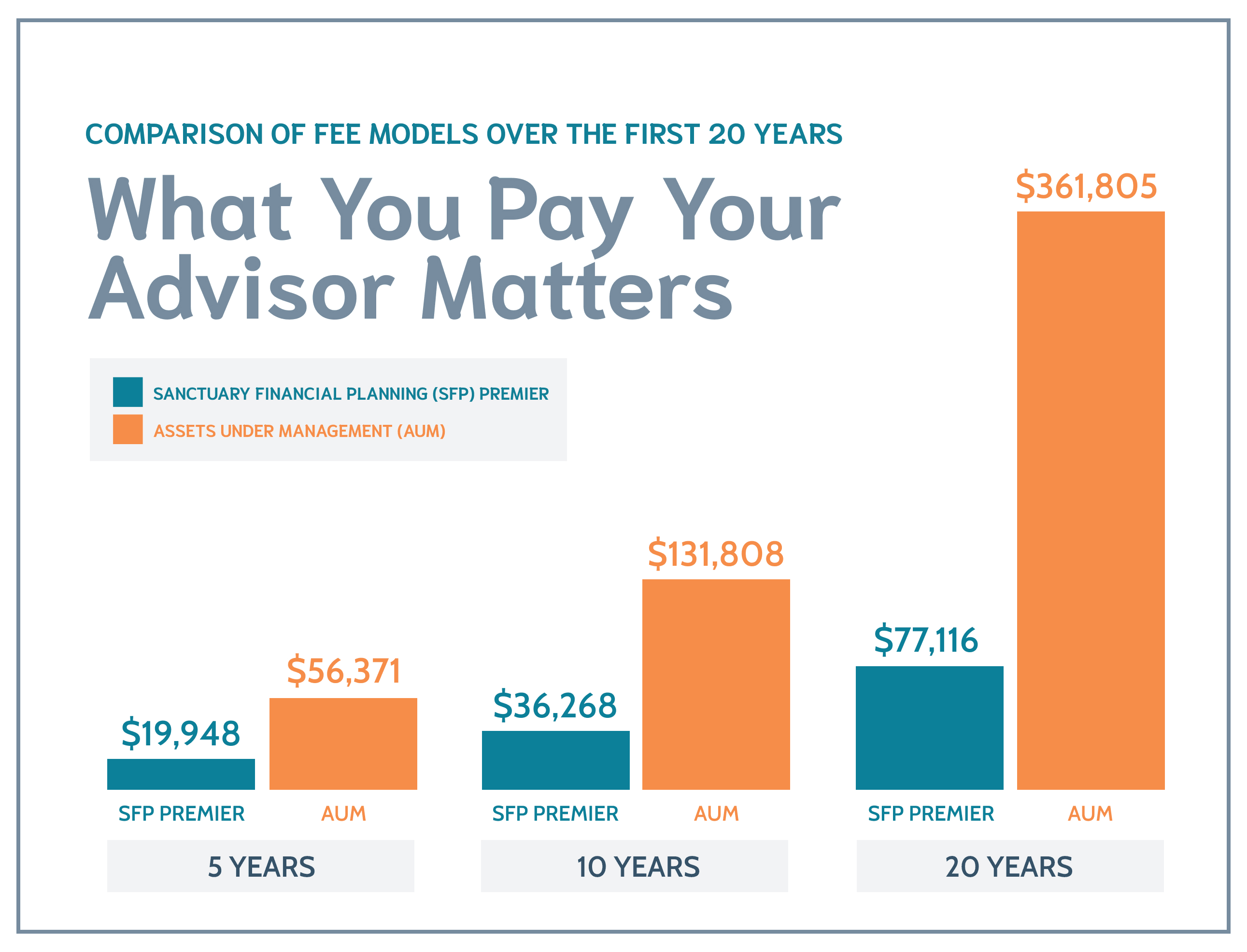

Because what you pay your advisor matters.

Most advisors charge based on the value of the assets they are managing for you.

This means that as your assets grow, your fees grow.

But with Sanctuary, your fees remain fixed.

The only person who makes more money when your assets grow is YOU!

Hypothetical illustration comparing fee models over a 5-year, 10-year and 20-year period. Examples include (i) Sanctuary Financial Planning Premier planning package plus ongoing support starting in year 2; assumes monthly fee of $229/month in year 2, growing by ~ 3%/year every year. (ii) $1,000,000 portfolio managed at 1% annually until $3,000,000 at which point the annual fee drops to 0.80%; assumes portfolio growth of 6%/year. The assumptions in this illustration reflect common industry averages; actual examples may vary significantly.

Imagine what you could do with savings like this!

How do you get started?

Free Inquiry Call

A 15-30 minute chat

It all starts with a call. Let’s get to know one another! Ask your questions, tell us about yourself, and decide if we’re a good fit.

Free Discovery Call

A 60 minute deep dive

On our second call we’ll learn more about your situation and how we can help you. We’ll take you through the process, show you what it’s like to work with us, and give you our recommendations and pricing.

Choose your plan

Basic, Core, or Premier

Decide which of our fixed-fee planning packages are best for you and your needs!

Sanctuary Planning Packages

Basic Plan

For those with basic planning needs starting out on their wealth-building journey

Includes

Before the Numbers: Explore your preferences, perspectives, and values

Cash flow, goals, and savings analysis

Review tax allocation & basic tax planning opportunities

Beneficiary and title review

Insurance (life, disability) analysis and recommendations

Review and recommendations for employer-sponsored retirement plan

Estimated Length of Engagement:

4-6 weeks

Number of meetings:

3

Pricing

$2,500

Deposit: $1,250

Balance due upon completion

Core Plan

For those navigating multiple financial decisions

Includes everything

in the Basic Plan PLUS

Insurance analysis (long term care) and recommendations

Education analysis

Home purchase/relocation

Charitable giving strategies

Review and recommendations for up to 6 personal investment accounts

Estimated Length of Engagement:

3-4 months

Number of meetings:

3-5

Pricing

$5,500

Deposit: $1,600

$1,300/month for 3 months

Premier Plan

For those with more complex planning needs, business owners, and those nearing retirement

Includes everything in the

Basic and Core Plans PLUS

Equity compensation and/or business owner planning

Roth conversion strategy

Retirement income distribution strategy

Review of existing annuities along with recommendations

Review and recommendations for up to 20 personal investment accounts

Implementation of your plan

A full year of ongoing support

Estimated Length of Engagement:

1 Year*

Number of meetings:

5+

Pricing

$8,500

Deposit: $2,000

$1,300/month for 5 months

*The Premier Plan process is usually 6 months, but the plan includes implementation and ongoing support for a full year.

Payment plans available upon request.

Putting your plan into action

Now that you have a plan in place, you have the option of working with us to implement it!

Implementation Includes

Proactive follow-up to help you put your plan into action

Review of your paperwork for transfers and rollovers

Assistance with rollover calls

Assistance with trades

Answers to your questions and help navigating unexpected obstacles as you move toward your financial goals

Pricing

$1,000

(Included as part of the Premier Planning Package)

What happens next?

Financial planning is a process. As your life changes, your plan needs to change with it!

Flat-Fee Financial Planning FAQs

Do I need to live in a particular state to work with you?

We are a virtual practice and can serve clients in all 50 states.

If I am local, are you willing to meet in person?

For local clients we are happy to meet in person. Sanctuary does not currently have office space, so we are able to meet at your home/office. Travel charges may apply.

Does my spouse need to be involved?

No. We do not require that both spouses engage in the planning process. However, we do need to meet with anyone who is going to sign the Client Service Agreement (CSA).

How much money do I need to work with Sanctuary Financial Planning?

Sanctuary has no asset minimums as we do not manage assets. If you see value in our services and can afford our fee, we would be happy to work with you. The only minimum we have is 4 hours’ worth of work.

Are you fiduciaries? What does that mean?

We are fiduciaries which means we are required to do what is in the best interest of the client and disclose and manage any potential conflicts of interest. It is the highest standard of care in the industry – and not everyone is held to it.

Do you earn commissions on your recommendations?

We don’t sell products and we don’t earn commissions on anything we recommend; we are fiduciaries solely focused on what is best for you.

Are there any conflicts of interest I should be aware of?

Many advisors have conflicts tied to their compensation. For brokers who sell products and receive commissions, that’s a potential conflict. For advisors who charge a percentage of assets under management (AUM) there is always the incentive to seek to manage more assets.

As an advice only firm, Sanctuary doesn’t have these conflicts found in many other wealth management firms. And as a fiduciary we are required to 1) do what’s in the clients’ best interest 2) disclose any conflicts that may arise.

What is your investment philosophy?

Our investment philosophy can best be summed up by this quote from Nobel-prize winning economist Paul Samuelson: “Investing should be dull. It shouldn’t be exciting. Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

At Sanctuary we believe that markets are efficient, and that clients are well served by a globally diversified portfolio comprised of low-cost ETFs and mutual funds. We use financial science and academics to guide our decisions, and we don’t believe in market timing or individual security selection.

Do you charge for Inquiry Calls or Discovery Calls?

No. Both Inquiry Calls and Discovery Calls are free. This is our opportunity to get to know each other and determine the best path forward for working together. There is zero charge until you sign your Client Service Agreement (CSA).

Can I combine planning packages?

No. The flat-fee planning packages we offer represent the most common planning scenarios we see with clients. If your situation doesn’t align with one of our packages, then we may be able to work with you on an hourly basis. However, we do allow you to upgrade your package from Basic to Core or Core to Premier if we mutually agree that a different level of service is needed once we begin working together.

What if I want to upgrade to a higher-level plan?

We do allow you to upgrade your package from Basic to Core or Core to Premier if we mutually agree that a different level of service is needed once we begin working together. You will sign an updated Client Service Agreement (CSA) and we will provide an updated payment schedule for the difference in fees. If you choose to upgrade to Premier, the date of your initial CSA will serve as the starting point of the 12-month engagement.

What if I decide this isn’t for me partway through the process?

Clients may terminate at any time by providing written notice. If you have paid your fees in advance, then a prorated refund will be given, if applicable, upon termination of the engagement. For fees paid in arrears, you will be charged a pro-rata fee based upon the percentage of the work done up to the date of termination.

What if I only need help with one specific financial challenge?

Our hourly planning services are designed to provide flexibility for clients who need help with a specific issue versus a comprehensive plan.

How do I know if I should choose a flat fee package or hourly advice?

The purpose of the Discovery Call is to understand the specifics of your situation and provide guidance on the most appropriate way for us to work together.

Will I be working with Sarah or Jim?

As a small start-up, Jim and Sarah work jointly with most clients.

Are you ready to take control of your financial life?

Schedule your free Inquiry Call to get started toward finding your financial sanctuary.

- Learn how we can help

- Ask all of your questions

- Decide if we're a good fit