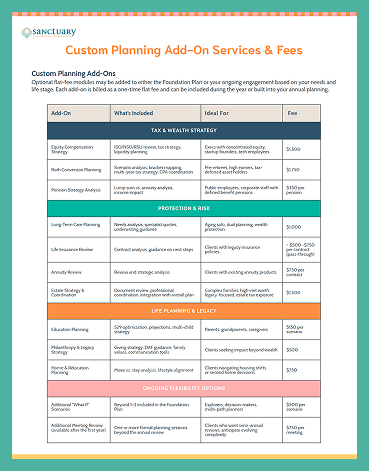

Financial Planning Add-Ons

Add-ons let us go deeper where it matters most, with tailored services so your plan always fits your priorities.

Your à la carte menu for life’s complexities

When your situation calls for specialized advice, you can expand your planning with these add-ons. We’ll help you decide which ones matter now — and which can wait until later. It’s a flexible approach designed to give you what you need, when you need it.

Add-Ons

How it works

Add-ons are built for flexibility. They can be woven into your plan at any stage — during your Foundation work or in the years that follow. We’ll recommend them when they align with your goals and add meaningful value.

We’ll decide together what makes sense — and when.

Add-ons are designed to flex with your life. Every year we’ll talk through your goals, timing, and capacity to figure out which areas need deeper planning.

Sometimes less is more.

Not every chapter brings complexity. When life is calm, your Foundation Plan and Ongoing Advice may offer all the clarity and direction you need.

Always optional.

Always up to you.

You’ll never be pushed into extra services. If an add-on isn’t relevant or valuable to you, we won’t recommend it. Simple as that.

Tax & Wealth Strategy

- Equity Compensation Strategy

If you have stock options or company shares, we’ll help you understand the tradeoffs, avoid surprises at tax time, and make smarter decisions about when and how to use them.

- Roth Conversion Planning

We’ll look at whether shifting some retirement savings now could save you money in the long run — and help you map out the right timing and strategy if it does.

- Pension Strategy Analysis

If you’re offered a pension, we’ll break down your choices and help you decide which payout option best supports your overall retirement plan.

Protection & Risk

- Long-Term Care Planning

We collaborate with a trusted insurance professional to explore specific policy options — and how they might support your broader financial goals.

- Life Insurance Review

For life insurance reviews, we turn to an independent actuary and consumer advocate for unbiased analysis focused solely on your best interests.

- Annuity Review

If you own an annuity, we’ll help you understand how it works, how it fits into your plan, and whether it still supports your goals.

- Estate Strategy & Coordination

We’ll review your will and other documents, identify any gaps, and help coordinate with your attorney so your estate plan reflects your wishes and supports your broader financial strategy.

Life Planning & Legacy

- Education Planning

Saving for college? We’ll help you estimate future costs, choose smart ways to save, and balance education goals with the rest of your financial plan.

- Philanthropy & Legacy Strategy

We’ll help you create a thoughtful giving plan that reflects your values — and, if you choose, explore ways to involve your family in the conversation.

- Home & Relocation Planning

Whether you’re thinking about moving, downsizing, or buying a second home, we’ll analyze how housing fits into your lifestyle and financial strategy.

Ongoing Flexibility Options

- Additional “What If” Scenarios

Want to explore more possibilities? We can model additional scenarios beyond what’s included in your Foundation Plan.

- Additional Meeting Review

If you want to check in more than once a year, we’re happy to meet again — whether it’s to revisit your plan or talk through something new.

Financial Planning Add-Ons FAQs

How do I choose which add-ons I need?

You don’t have to decide on your own — we’ll help identify the right add-ons based on your goals, complexity, and timing. Add-ons are recommended only when they’re relevant to your life.

What if I need multiple add-ons over time?

That’s totally normal. Some years you might need one or two add-ons, and other years none at all—it all depends on what’s happening in your life.

Can I add services mid-year?

Yes. We can always adjust your engagement or add additional services if your needs evolve during the year.

Are add-ons required for ongoing planning?

No. Ongoing Financial Advice doesn’t require any add-ons. They’re simply available when extra support or deeper analysis is needed.

How much do Add-Ons cost?

Add-On pricing varies based on the scope and complexity of the work. We’ll outline the fee clearly before you commit—no surprises, no hidden costs. Download our Add-On Pricing Menu.

Can I purchase an add-on without a Foundation Plan?

Not typically. We believe everyone deserves a strong planning foundation. The only services we offer on a stand-alone basis are Retirement Coaching and Hourly Planning.

Why aren’t Add-Ons included in the Foundation Plan?

We designed the planning process to be flexible. Customized not just by client, but by timing. Add-Ons let us combine the clarity of flat-fee pricing with the responsiveness of hourly work, so you only pay for what you need, when you need it.

Helpful Takeaways

Are you ready to take control of your financial life?

Schedule your free Inquiry Call to get started toward finding your financial sanctuary.

- Learn how we can help

- Ask all of your questions

- Decide if we're a good fit