One service. One fee. Everything you need.

Comprehensive Wealth Management includes financial planning and investment management for one transparent, flat quarterly fee.

Comprehensive Wealth Management

One service. One fee. Everything you need.

Comprehensive Wealth Management includes financial planning and investment management for one transparent, flat quarterly fee.

What’s included

Integrated Financial Planning

From retirement strategy and tax planning to Social Security, healthcare and legacy – your entire financial life mapped out and maintained.

Professional Investment Management

Your portfolio designed, managed, and monitored by experienced advisors who understand how your investments serve your life.

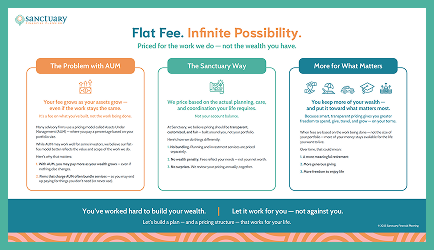

A Flat Quarterly Fee

Unlike traditional AUM advisors, our fees don’t change as your assets increase. So the only person who makes more money when your investments grow is YOU!

What guides us

You're not a spreadsheet—you're human

Financial decisions are emotional. Your plan should honor that, and your portfolio should support the life you’re building.

Simplicity wins

Low-cost, globally diversified portfolios. Clear, actionable plans. No unnecessary complexity. Just straightforward guidance you can understand and act on.

Markets reward patience

We help you stay disciplined and focused on the long term — even when emotions run high or headlines get noisy

Clarity creates confidence

We believe financial advice should be transparent, not confusing. That’s why we offer flat-fee pricing that minimizes conflicts of interest.

Planning is a framework, not a crystal ball

Life doesn’t follow a script. A flexible plan helps you prepare, adapt, and pivot with confidence — no matter what comes next.

Purpose drives everything

Your money should reflect what matters most to you. We help you use your resources with intention — so your financial life aligns with your values.

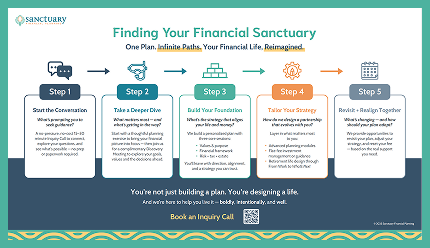

How we work together

Discovery

We start by getting to know you and your current financial situation. We’ll review your accounts, income, expenses, and current plan.

Before the Numbers

We explore your relationship with money, your values, and what you want your financial life to support. This is where we craft your Statement of Financial Purpose.

Financial Framework

We build your retirement income strategy, map out cash flow, and stress-test your plan — so you can see exactly what your retirement paycheck will look like.

Investment Strategy

We design and implement your portfolio—aligned with your plan, your risk profile, and your goals.

Protect and Optimize

We address taxes, insurance, and estate planning—the pieces that protect your wealth and optimize your legacy.

Your Financial Co-Pilot

Your plan is built. Now comes the best part: living it. We meet regularly to make sure your plan evolves with your life—keeping your eyes on the road ahead, not the rearview mirror.

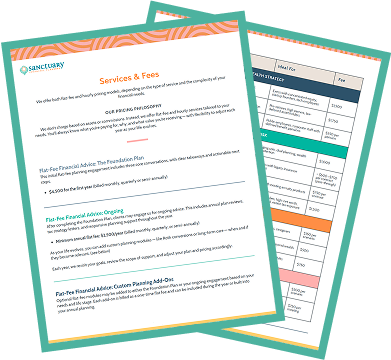

Pricing

Our comprehensive wealth management is delivered for a flat fee of $2,450 per quarter

What's Included

Integrated financial planning

Investment management

Ongoing guidance and support

Unlimited access to your advisors

Your fee may adjust annually with inflation (CPI-U) to reflect the rising costs of services and to ensure the sustainability of our practice and our ability to continue delivering exceptional service.

Special circumstances: This fee structure works for most clients, though more complex situations—such as business ownership, taxable estates, or intricate family dynamics—may require adjusted pricing to reflect the additional expertise and coordination involved. We’ll discuss this during our initial conversations.

What do our clients think about working with us?

These clients have not been paid or received any compensation for providing testimonials, and there are no material conflicts of interest.

Just some of the situations we help with

The Foundation Builders

Maya & Peter

Maya and Peter are financially stable, but growing wealth brings complex choices around housing, college savings, estate planning, and investments.

The Strategic Structurers

Chris & Monica

Chris and Monica are doing well and saving steadily, but with kids in school and college, they’re now weighing tuition, retirement moves, and long-term flexibility.

The Transition Testers

Mark & Jenna

Mark and Jenna are eyeing major life changes, including career shifts, travel, and honoring a philanthropic pledge—all while considering a drop in income.

Living the Plan

Noah & Avery

Noah and Avery are excited to retire but overwhelmed by pension choices, rollovers, Social Security, Medicare, and replacing their paychecks.

Refining Life and Legacy

Eleanor

Eleanor is financially secure but seeking simplicity through downsizing, giving during her lifetime, and ensuring her plans reflect her values and are clear to her family.

Helpful Takeaways

Services & Fees

A full menu of our services, our prices, and how it all fits together.

Are you ready to take control of your financial life?

Schedule your free introductory call to see if Comprehensive Wealth Management is right for you.

- Share your situation and what you’re hoping to accomplish

- Learn how we work and what’s included

- Decide if we're the right fit and determine the best path forward